Capitalism means that only the capital deserves profits, workers are not entitled to profits, nor anyone else who contributed in making these profits. This is what Capitalism is about, where its name stems from.

Post-Capitalism claims that if capital and labour work together to create wealth; they both deserve a share in it. It is a philosophical stance, a change of perspective to help us make Capitalism, inclusive, fair, and considerate.

Apart from that, they are similar: Post-Capitalism is an evolution of Capitalism; it keeps the good in it (free market, individualism, property rights, creative potential, etc) whilst avoiding its negative impacts (concentration of wealth, creation of inequalities and poverty).

Back to TopNot officially, no.

Alternatives to Capitalism exist: at one side of the spectrum, there are various forms of collectivism, which aim at removing individual property altogether or abolishing the distribution of profits. This has limited scope for progress, as explained in the FAQ on Co-operatives, collectivism and Communism.

At the other end of the spectrum, there are various forms of social redistribution system i.e. the welfare state of our modern economies, whose objective is to offset the negative impacts that Capitalism inflicts on society. Yet these only provide palliative care to the people suffering from our economic system, without ever addressing what caused the problem in the first place, as detailed in the FAQ on Redistribution.

Post-Capitalism is radically new, it is emerging as a new paradigm, as it considers workers to be entitled to profits together with capital, insofar as they are both legitimate beneficiaries to the wealth that they generate together.

Back to TopRemunerations are a running cost to the workforce, just as maintenance and depreciation are running costs to machinery and property. Workers receive a wage because they need to eat, clothe themselves, have a roof over their heads, etc. It’s required for their subsistence, to keep doing what they do, like a machine needs power and maintenance to run.

Therefore, both Capital and Labour are paid their operating costs, to keep them working in optimal conditions. On top of that, over and above the running costs, there are profits, these are the ones that are shared under Post-Capitalism.

Back to TopNo, what is yours remains yours. It is only the profits that your wealth produces that are shared with the workers. Post-Capitalism is not about making the rich pay for the poor; there is no transfer of wealth from the Capital to the Labour, only the profits that Capital and Labour have produced together are shared.

Post-Capitalism encourages the generation of profits, and therefore it produces the same wealth as Capitalism, only the outcomes differ. With Post-Capitalism, the profits are shared with whoever helped generate them. It is not about how much profit you get, it is about who made it happen and who gets the reward.

Back to TopYes. Post-Capitalism rests on the same structure of our current economic model (liberalism and free trade) and it is compatible with the mainstream western behaviours and beliefs (private property and self-determination).

Post-Capitalism creates wealth in the same way Capitalism does, but when it distributes profits it also includes employees –or anyone contributing to generating profits- as part of the final beneficiaries; “If you make profits selling food, you share the cake with the cooks who made it!”.

Back to TopNo. Our liberal economic system - and the so-called Social Market Economy - mostly rely on the capital to produce wealth, and it provides a safety net of social benefits and welfare for the needy, the ones left behind by Capitalism. Taxes can be an efficient redistribution mechanism to reduce inequalities, but they don’t address the root cause of the problem. Taxation actually reinforces the system of inequality because it depends on it: without inequality, there would be no taxes. Moreover, taxes often further increase the divide, for instance when landlords become the ultimate beneficiaries of housing benefits in the private rental sector, thus increasing their wealth at the expense of the taxpayer.

Post-Capitalism doesn’t create inequalities in the first place. By rewarding both Capital and Labour for their endeavours, it spread the wealth between the factors of production from the start, thus reducing the need for government intervention and welfare redistribution altogether.

Back to TopNo. Post-Capitalism is an Evolution of our current mindset, using the good that Capitalism has to offer without the bad.

Anti-Capitalism talks about Revolution and replacing Capitalism with something else. It aims at defeating Capitalism, in a confrontational way, like a war.

Post Capitalism is about consideration; it respects private property without adhering to the exploitation it creates, as it considers all parties involved in the process when distributing profits. Post-Capitalism is not fighting the shareholders, the state or some evil authority, it leaves it to the individual to evolve towards a more equal society by making more considerate choices.

Co-operatives are effectively similar but technically different to Post-Capitalism. Yes, the workers get profits, but not because they are workers but because they are shareholders.

Co-ops reconcile the interests of labour and capital by giving their members a double hat: that of the worker and that of the shareholder.

Yet, it doesn't challenge the basic tenet of Capitalism that only the owners of shares are entitled to profits. Therefore, although co-operatives are morally similar to Post-Capitalism, they follow a traditional capitalist structure, where only the shareholders are entitled to profits.

Also, there is an inherent problem of funding within co-operatives. More often than not, co-operative members don’t have the financial capital to invest, which makes them highly dependent on institutional funding, a problem that is especially acute in the housing market.

Back to TopYes, except that Fair Trade applies mostly to the international trade of Labour-intensive products manufactured in developing countries and sold in the developed world, whereas Post-Capitalism applies anywhere, and in any sector, for services as well as for production units.

In essence, they both achieve similar results: whereas Fair Trade focuses on better remuneration for the workforce, thereby reducing profits for the investors, Post-Capitalism distributes profits back to the workers, thus also improving their lot.

Back to TopNo. Post-Capitalism is an evolution of Capitalism; it introduces a tweak in its main working principle -consideration-, so nothing to do with Communism.

In a nutshell, whilst Capitalism accumulates wealth in the hands of a few and communism eradicate private wealth entirely, Post-Capitalism spreads the wealth in the hands of individuals in a decentralized way.

No. If left to its own devices, Capitalism creates accumulation of wealth, concentration of power and ultimately monopolies with perverse effect on price manipulation and lack of choice, to the detriment of all of us. Modern economies fight this with anti-competition laws and regulations, but they can’t stop the ever-increasing power gathered by corporations, because this is embedded in the fabric of how Capitalism works.

Furthermore, when things go sour, Capitalism often relies on the principle of privatisation of profits and socialisation of losses, which fuels inequalities as the employees lose their jobs, and if there is a public bailout, the wealth gap increases between the taxpayer who foots the bill and the investors who have pocketed the profits.

Post-Capitalism does not generate inequalities in the first place as both investors and workers receive profits. This also means that as it spreads profits more widely into society, where the socialisation of losses can only happen to a lesser degree. Instead of creating Monopolies that accumulate wealth in a few hands like today (think of Microsoft or Amazon, but also your local convenience store being replaced by a chain supermarket, delocalising profits and ruining the local economy), Post-Capitalism creates a Sociopoly where everyone benefits from the creation of wealth.

Back to TopProfits are the reward for any investor taking a risk, and they must be enough to justify the investment. This is true for Capitalism as well as Post-Capitalism.

Post-Capitalism also considers workers worthy of profits because they often bear the brunt of the losses: the first reflex of companies to absorb losses is to lay off their employees. In this scenario, the employees pay the losses whereas investors cash in the profits.

In Post-Capitalism, losses are covered the same as in Capitalism: the profits of one year compensate for the losses of another year if required, and profits are only shared when available. To make it safe for investors, profits are retained within the company as a safety net, so if there are losses, the safety net compensates the investor. This is explained in detail in the FAQ on When should profits be distributed?

Back to TopNo. The risk of businesses in Capitalism and Post-Capitalism are the same, what changes is the amount of expected returns for the investor. Since Post-Capitalism distributes less profit to the investors, the expected return is lower given the same level of risk.

Therefore, Post-Capitalism doesn’t penalise the investors in favour of the workers, it just shares the profits between them. The deal between investors and workers is this: when there are profits, they all share in them, and when there are losses, they all share in the loss as well.

Back to TopUnder Capitalism, the expected return is a direct measure of the risk, and the greater the risk, the greater the expected return for the Capital.

With Post-Capitalism, the same applies, but since profits also go to the Labour (that doesn’t invest Capital), special consideration must be given to the risks involved for the investors.

Different arrangements will suit different investors depending on their risk aversion or the relative weight of Capital to Labour in the company i.e. the Capital/Labour ratio. For instance, risk-averse investors in a Capital-intensive business may prefer fixed returns to cover their investments, whereas more liberal investors in Labour-intensive companies may choose to go 50/50 with their workers, as explained in the examples below.

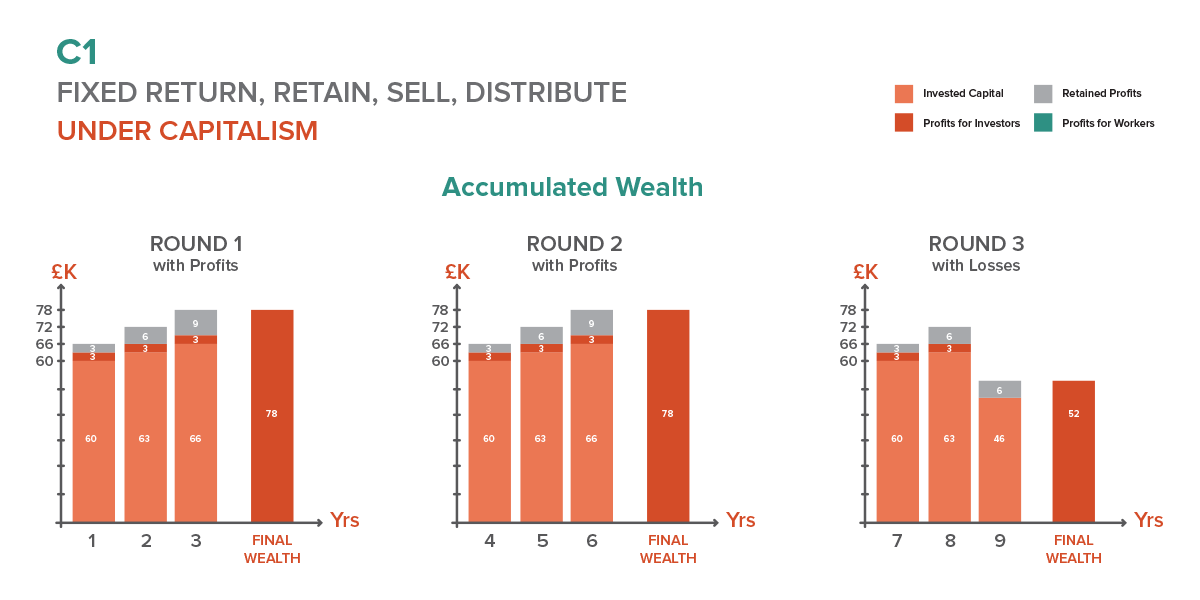

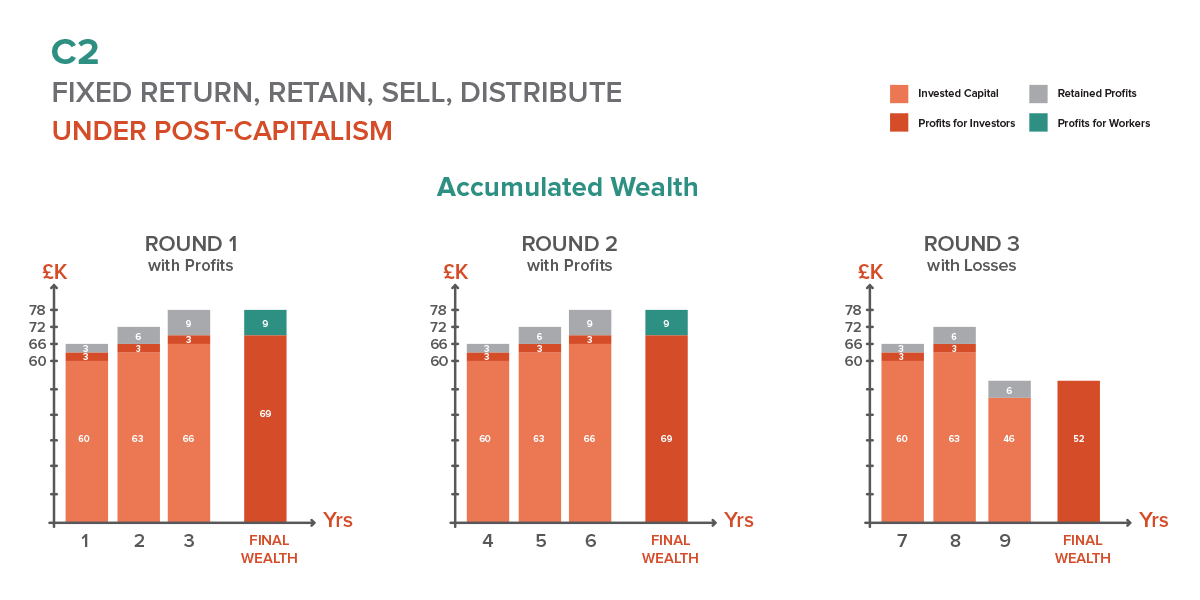

Based on the numerical example on the Home page we show the results of various alternatives, assuming the following:

The profits are retained -as a safety net- to cover for potential losses and the distribution of profits only happens once the business changes hands in years 3, 6 and 9. This ensures that investors recoup their losses before the distribution of profits to the workers, so it is safe for the investors.

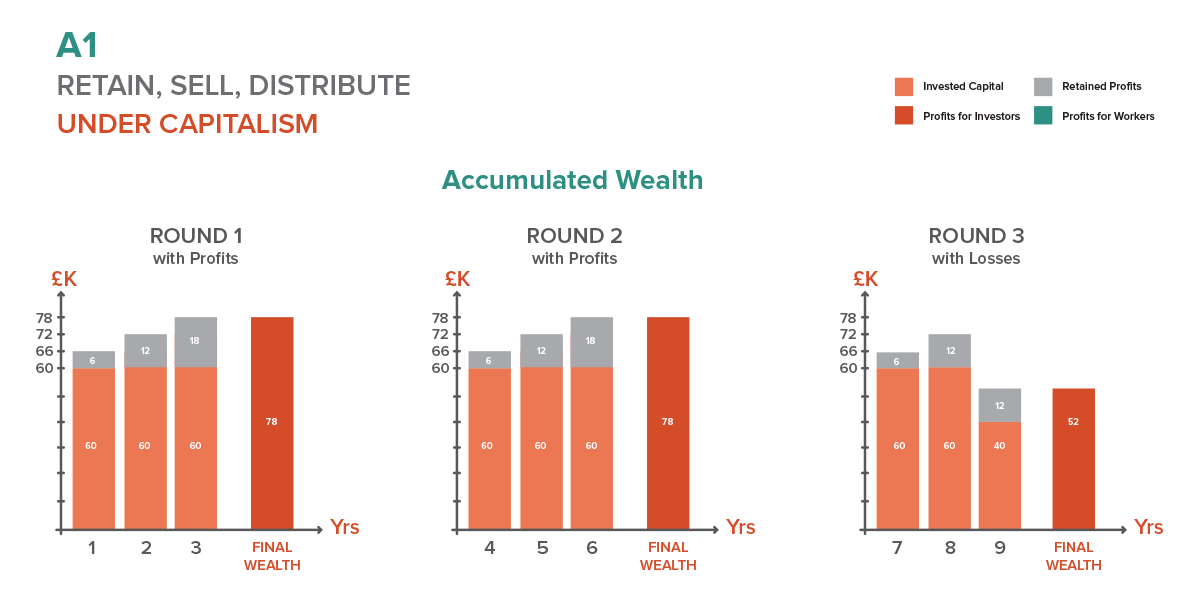

A1 - Example under Capitalism:

Over the first 3 years, the business makes £18k profits that are kept in reserves, and the business sells for £60K, so the first investors walk away with £78K in total. In round 2, the same happens between years 4 to 6 for the second lot of investors.

In the third round, profits are retained in years 7 & 8, and in year 9, the investors sell the asset for £40K and take the £12K reserve profits, so they walk away with £52K final wealth.

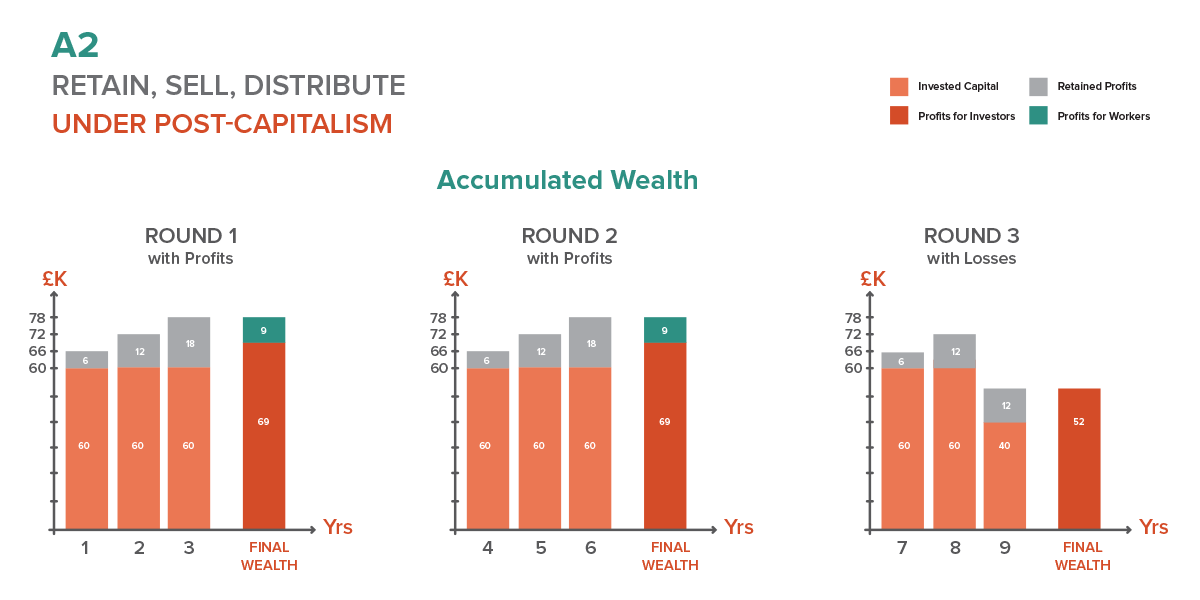

A2 - Example under Post-Capitalism:

The first lot of investors gets their £60k back plus £9k profit, and the workers receive £9k. Same in round two for the second lot of investors and the workers between years 4 & 6.

In the third round, the investors make £6k profits per year that are saved aside in years 7 & 8. In year 9, the investors sell for £40k and take the overall £12k retained profits, so they walk away with £52k, just as in Capitalism above. The workers walk away with nothing for years 7 & 8 and they may lose their jobs.

Therefore, Capitalism and Post-Capitalism give the same protection to investors in case of losses: they walk away with £52k final wealth in both scenarios.

NOTE: The proportion of profits distributed between Capital and Labour will depend on the ratio of Capital to Labour specific to the business, to give a fair chance of profits distribution between the factors, as explained in the FAQ: How Much Profit should go to the Workers?

In traditional Capitalism, profits are distributed regularly e.g. yearly dividends, and the last investors absorb all the loss. So if the business fails in year 9, all the profits distributed previously are lost to the last investors, as they cannot claim their loss against profits already distributed. This is when Privatisation of profits and socialisation of losses happen.

Likewise, with Post-Capitalism, the investors cannot claim back their share of the profits distributed to the workers, so when losses happen, the share of profits distributed to the workers are lost to the investors, actually increasing their overall losses. Therefore, distributing profits before selling the assets is the riskier option for the investor under Post-Capitalism, which would be a case of “socialisation of profits” as opposed to what Capitalism normally produces.

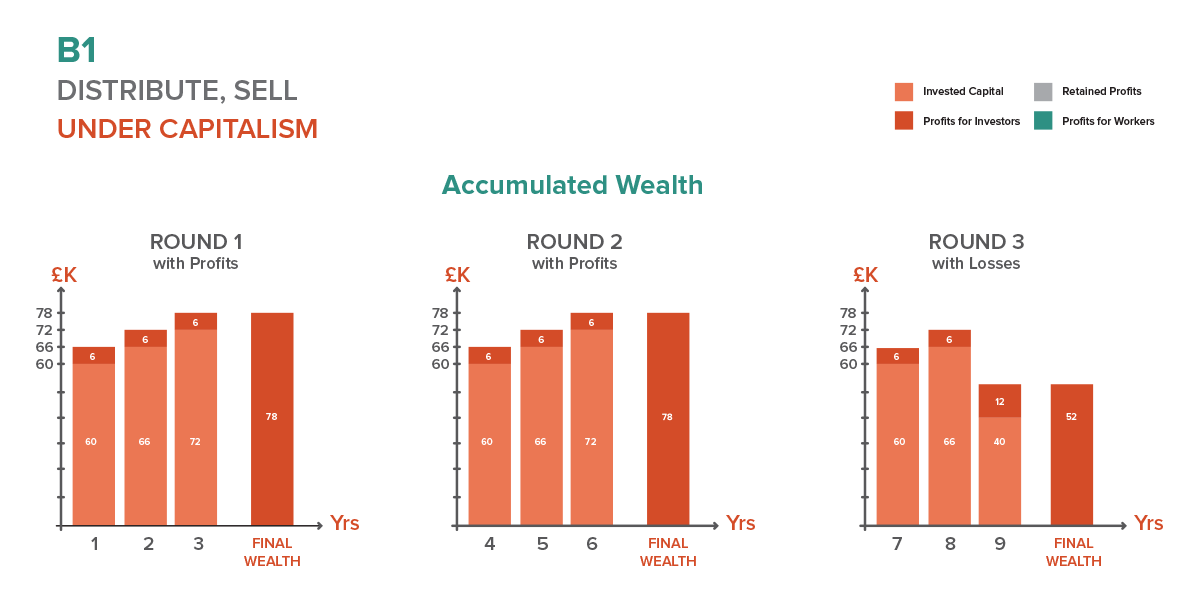

B1 - Example under Capitalism:

As in A1, the investors keep all profits in the first two rounds, and the third lot of investors walks away with £52K final wealth in year 9.

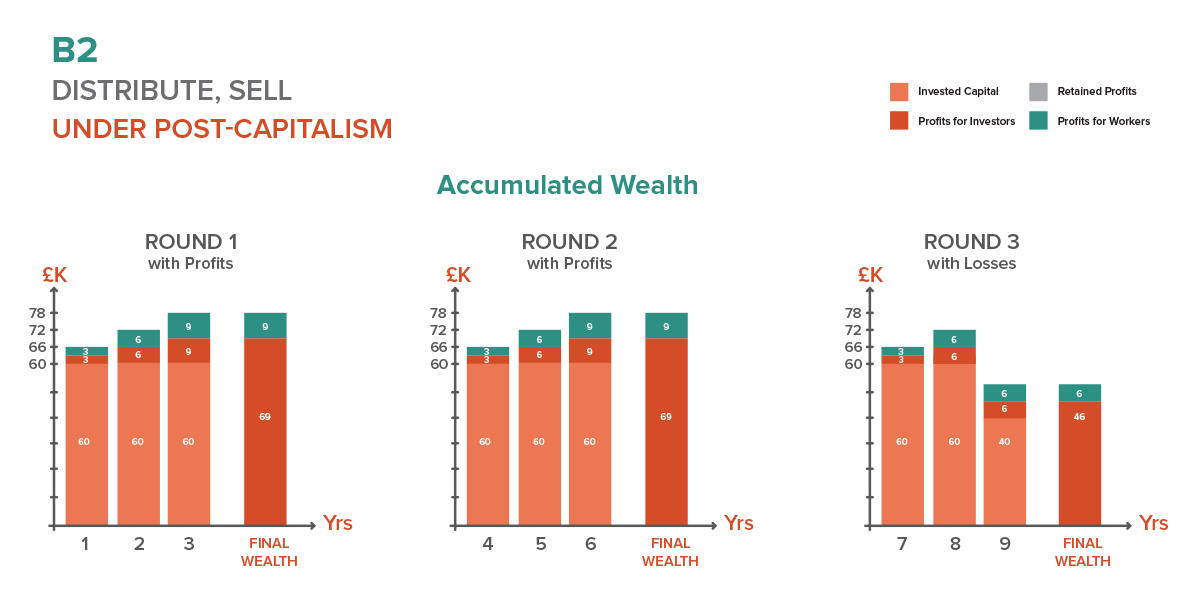

B2 - Example under Post-Capitalism:

The first round of investors sells for £60K and walks away with £3K profit each year, and the workers receive the remaining £3K per year, so the investors take £69K final wealth. The same happens between years 4 to 6 for the second lot of investors and the workers, who receive £9K profit each in total.

In the third round, the investors and the workers both receive £3K profits for years 7 & 8. In year 9, the investors sell and walk away with £46K (£40K from the sale and £6K profits), and the workers make £6K profits for years 7 & 8 and then may lose their jobs.

As in Capitalism, the last investors assume the loss in round 3, but having distributed the profits to the workers increases their losses by £6K i.e. £3K distributed in years 7 & 8 to the workers.

This is as A) above but with a fixed yearly profit to the Capital (interest or dividend) and when the business is sold, any remaining profits go to workers. This is the favoured option for risk-averse investors who prefer a fixed return over a volatile one.

C1 - Example under Capitalism:

The numerical example is similar to A1 or B1 above as the investors get all the profits in the end regardless of the distribution arrangement.

C2 - Example under Post-Capitalism:

Assuming a fixed rate of 5% Return on Investment per year, the investors would receive £3K per year. Upon sale in year 3, the investors get £69K, and the £9K remaining profits upon sale would go to the workers. The same happens in round two for investors and workers.

In round three, the investors receive £3K in years 7 & 8, and when selling for £40K in year 9, the £6K retained profits go to the investors, who walk away with £52K final wealth. The workers don’t get profits in that round and may lose their job.

As in scenario A) above, Post-Capitalism is as safe as Capitalism for the investors, whereas workers will have received profit distributions in years 1 to 6 when these are available.

For instance, a fixed return of 2% and then profits shared upon sale of the assets using a weighted factor between Capital and Labour.

For a more detailed explanation of this see FAQ How much profit should go to the workers?

Back to TopWith Capitalism, the distribution of profits normally happens at regular intervals e.g. yearly interest, quarterly dividends, monthly rents, etc. This poses a major problem when losses happen: the last owner of Capital endures the losses. For instance, if you purchase shares and their price drops, as the last buyer you absorb the losses on your own, and all the profits made by previous owners are lost to you.

The same happens under Post-Capitalism: the last investor bears the brunt of the losses if and when they happen. To make it as safe as Capitalism for the investors, profits to the workers should not be distributed throughout the operation but rather saved aside as a safety net, as explained in the FAQ on Risk and Returns.

This poses another risk for the Labour: if the business never sells and the assets or shares never change hands, the workers may never see their share of the profits. Therefore, whenever profits are reserved, a clause of compulsory transfer of the assets must be in place so that these change hands within a reasonable time e.g. 5 years or similar. This way, investors can decide to renew their commitment and reset their risk taking at regular intervals.

NOTE: To protect the interests of the workers in the long run, all of the profits are retained until the sale, including the share going to the investors. If profits are distributed yearly to investors while only the share of the workers is saved aside, the workers may never see their share of the profits, because investors may never sell on. Therefore, keeping all the profits as a safety net keeps the incentive to sell or transfer the assets so that they all receive their share at the same time.

Back to TopUnder Capitalism, you can have a hundred workers working for a few investors e.g. a factory, or a few workers working for hundreds of investors e.g. a high-tech software company; the result is the same: 100% of the profits go to the investors and none to the workers. Under Post-Capitalism Capital and Labour share the profits, but how much?

Post-Capitalism rewards Capital and Labour according to their relative contribution to the production process, i.e. the Capital/Labour ratio. For instance, if the investors contribute £100k and the workers put £100k worth of labour in the company, they both receive the same amount of profits. Therefore, Capital and Labour share the profits proportionally, depending on their input.

This weighted participation accounts for differences in factor intensity between Capital and Labour, where Capital investments greatly surpass labour contribution and vice-versa. The possibilities are:

For example: in a Labour-intensive company with a Capital to Labour ratio of 1:3 (e.g. a nursing home), the distribution of profits could mirror the ratio of £1 to Capital for each £3 given to Labour.

On the contrary, for a Capital-intensive business with a ratio of Capital to Labour of 2:1 (e.g. web-hosting), the distribution at the end could be £2 to the Capital for each £1 to the Labour. These examples are analysed in detail in the FAQ on Risk and Returns.

NOTE: To protect the interests of the workers in the long run, all of the profits remain in the safety net until the sale, including the share going to the investors. If profits are distributed yearly to investors while only the share of the workers is saved aside, the workers may never see their share of the profits, because investors may never sell on. Therefore, keeping all the retained profits saved aside keeps the incentive to sell or transfer the assets so that investors and workers receive their share at the same time

Back to TopIt depends. In Capitalism, the investors get the whole cake: the return on their investment (interests, dividends, rents, etc), as well as the increase of the price of their assets (share price, property value, etc).

Under Post-Capitalism, any increase of wealth is subject to distribution, including operating profits, retained profits, etc. This is a requisite of Post-Capitalism, otherwise, the workforce may never see their share of the profits. For instance, if profits are retained and reinvested within the company, it would increase the value of the Capital (share price, property value, etc) and penalise the Labour as the profits are transferred into Capital straightaway and never distributed.

Back to TopNo. Employee Share Schemes are a way for employees to benefit from profits by giving them shares in the company they work for. Yet this is still a capitalist setting: the workers who have shares in their company end up wearing two hats: as shareholders and as employees. By giving shares to their employees, shareholders don’t give up a portion of their entitlement to profits, they just extend this right to employees who become shareholders like them. Furthermore, shares are generally given at a cost, either as part of the salary or against a purchase price. Employees purchasing these -even at a reduced price- actually become investors as any other shareholder. Shares that reward shareholders are the cornerstone of capitalism, irrespective of who holds these.

Post-Capitalism is not about giving shares to workers but sharing the profits that the capital would normally keep for itself. For Employee Share Schemes to be Post-Capitalist, it would require ALL the employees to get shares (like a co-operative), the shares should be given freely to employees, and the ratio of Capital to Labour should be respected in the distribution of profits. As long as some shares remain exclusively in the hands of the Capital without a counterpart for the Labour, or if employees have to pay for them as an investment, it is Capitalism as usual. For example, if a company had two classes of shares (shares A for investors and shares B being distributed between investors and workers proportionally to their contribution to profits), shares A would be Capitalist whereas shares B would be Post-Capitalist.

With Post-Capitalism, workers are entitled to profits without the need to become shareholders, thus moving away from the central tenet of Capitalism, where only shareholders are entitled to profits.

Back to TopYes, provided the overall proportionality of profit distribution is maintained between Capital and Labour, as explained in this FAQ on How much profit should go to the workers.

Therefore, performance-based remuneration should be added over and above the normal wages of the workforce, diminishing the profits accordingly. Care must also be taken to consider the tax implications of this distribution so as not to unduly penalise the Capital or the Labour.

Back to TopYes. As an activity, speculation used to be confined to shareholders and property investors, yet it has become mainstream with cryptocurrencies and millions of people are investing their savings in some way or another expecting their investment to increase in value over time, be it properties, shares, etc.

Speculation doesn’t intrinsically create inequalities and/or poverty, so a company can issue shares that increase in price over time, and in a Post-Capitalist setting, the profits (dividends, interests, etc) would be shared between Capital and Labour, whereas the capital gain would revert to the investor only i.e. the Capital.

Back to TopIn traditional Capitalism, the investors have control over the business, and they are generally liable to the banks, authorities, taxman, etc up to their investment, as in limited companies.

The same happens in Post-Capitalism, and the purveyors of funds have control over the business. Investments and assets are owned privately, and therefore workers have no more input in a Post-Capitalist company than in any traditional enterprise.

Back to TopNot really, no. For Post-Capitalism to become the norm overnight, it would require for profit distribution to workers to become mandatory, to the detriment of the owners of Capital who do not approve of this. As the Capital is privately owned, its owners should be compensated for their loss, which is only fair.

In the UK, history shows how the Slavery Abolition Act of 1833 saw the government contracting a colossal debt to compensate their loss of wealth to thousands of slave owners at the time. The debt was finally paid back in 2015. If the government were to pass a Post-Capitalist law and compensate the owners of private Capital for their potential loss of profits, it would certainly be greater than what the compensation to the slave owners represented, which renders this option unfeasible.

Back to TopNo, the Labour Theory of Value is a radically different approach that requires overhauling the way we count, manage and understand business today. It considers labour as the only source of all wealth, and any good -including capital goods- ought to be measured in terms of the labour required to produce them. Although it makes sense intuitively, it is difficult to reach it from our current economic model, let alone our present mindset. If the labour Theory of Value was to prevail, it would create Labouralism, an economic model based on the value of Labour.

Post-Capitalism takes Capitalism as it is and includes the labour in the equation. You can do it here and now, in any sphere of economic activity. Post-Capitalism is therefore only a transition towards a Labouralist society, in which all wealth stems from the Labour input.

Back to TopCapitalism works on the basis that property rights entitle their owner to claim revenue without any counterpart, be it dividends, interests, royalties, rents, copyrights, etc. The owners of these rights are entitled to get money for it, not for their work- thus making someone else work to make this revenue happen.

The idea that the capital “works” for its owner is flawed; it is not the capital that works but someone else, and together with the Capital they create profits. In other words, Capitalism puts the labour at the service of the capital, thus exploiting labour insofar as profits are concerned.

This is not a new concept. In 1755 Rousseau identified property rights as the drivers of inequalities, creating riches for the owners and driving the have-nots into poverty.

In the 19th century, Marx made the exploitation of labour a central piece of his theory, and last century, R.T. Bye showed that the inequalities in the distribution of wealth arise from the fact that some of the revenues of capital are received without any work being produced, whereas the labourers only receive wages for their services, not profits.

Therefore, inequalities are an unintended consequence of Capitalism i.e. a negative externality embedded in its own fabric, and Capitalism creates wealth and inequalities at the same time.

Back to TopYes, because it stops them at the onset when wealth is distributed.

In this interesting report on inequalities from the OECD, inequalities have increased over the last few decades in general, and 40% of the population shares barely 3% of the available wealth. The report doesn’t mention the transfer of wealth happening in the housing market, and when it comes to inequalities created by the distribution of dividends, it suggests improving wages or applying redistributive measures to compensate low earners. This shows how the problems of Capitalism are still poorly understood and therefore not addressed by the governments.

Inequalities are the result of both income and wealth accumulation, and the latter has sharply increased the divide in recent years. In the housing market, this leads to wealth accumulation by landlords at the expense of their tenants who are paying for it. When tenants in the UK pay on average a third of their wage in rent, tenants are impoverished month after month to the benefit of the landlord without any retribution.

In comparison, Post-Capitalism generates the same wealth, but it spreads it equally between investors and workers. Instead of accumulating in the same hands, the wealth is distributed widely. It is a win-win that rewards both factors of production rather than the win-lose situation as in Capitalism, where the gains of capital are made to the detriment of the workers.

In housing, Post-Capitalism requires landlords to share the proceeds of the investment with the tenants, including the returns from rent and the capital gains on the portion of the investment financed by mortgages.

Back to TopThe name says it all: the main premise of Capitalism is that only capital is entitled to profits. To increase the profits, it must lower the costs –including Labour costs- and the lower the wages, the higher the profits. Delocalisation, dismissals and pay cuts are the result of this mechanism, in which the Capital gets the rewards at the expenses of the Labour.

The Capitalist mindset creates accumulation and concentration of wealth in the hands of the wealthy without regard to the inequalities it generates, the owners of capital being either unaware or unconcerned by it. This is what is called the economics of indolence.

Back to TopYes. Capitalism sees capital as the only factor entitled to profits. There is no rule preventing this, so it is commonly accepted and it has become the norm. But workers also contribute to the creation of this wealth, and the investor has a choice to make in that regard: either to keep it all or to allow the labour to get a share in the profits.

Post-Capitalism rests on the economics of consideration: if there is a cake to share, Post-Capitalism shares it with whoever helped cook it, not only the owners of the bakery.

Capitalism can only evolve if people decide to make it evolve. There are many proposals to improve Capitalism, but they look like wishful thinking waiting for someone else to do it. If you want to see Capitalism change, you have to change the way you do Capitalism yourself.

Back to TopNo, it has nothing to do with philanthropy, charity or generosity. Generosity requires giving something away, to give it free to someone who needs it.

Post-Capitalism is about distributing the profits, that is, the wealth that Capital and Labour have created together; it is not an act of charity because it recognises the legitimate right to get profits for everyone who helped create them. Whether the investor's money is inherited, won at the lottery or hard-earned is irrelevant, it serves the same purpose, generates the same wealth, and has the same rights to profits. Likewise, workers have a right to profits regardless of whether they are managers, clerks or temporary staff; if they have contributed to the wealth creation, it partly belongs to them.

Back to TopAnyone can choose to be a Post-Capitalist, anytime. Being a Capitalist is a decision, as is being a Post-Capitalist, the choice is yours. Like Fair Trade, Post-Capitalism relies on people willing to share the profits when doing business, using consideration in the way the wealth is distributed.

Some Post-Capitalist options:

No, it is individualism with consideration. It is neither collective nor communal; it is based on the private ownership of capital, just like Capitalism. Individuals have private enjoyment of their property, although the profits generated with such property are shared with whoever helped generate them.

Back to Top

Let’s face it, the housing system is lame. The current model is increasing inequalities in our society at an alarming rate, with one in three private tenant locked in poverty. If we want to afford tenants the stability and safety they aspire to, they must be able to secure a roof over their head and improve their financial situation in the long term.

Read Article